Budgeting Basics for New Parents: A Step-by-Step Guide

March 19, 2025, 9:01 a.m.

Becoming a parent is exciting, but it also brings new financial challenges. From diapers to daycare, costs can pile up fast. In this Budgeting Basics for New Parents: A Step-by-Step Guide, you’ll learn how to prepare for parenthood financially. We’ll cover key expenses, including fertility preservation costs, and share practical tips to keep your budget on track.

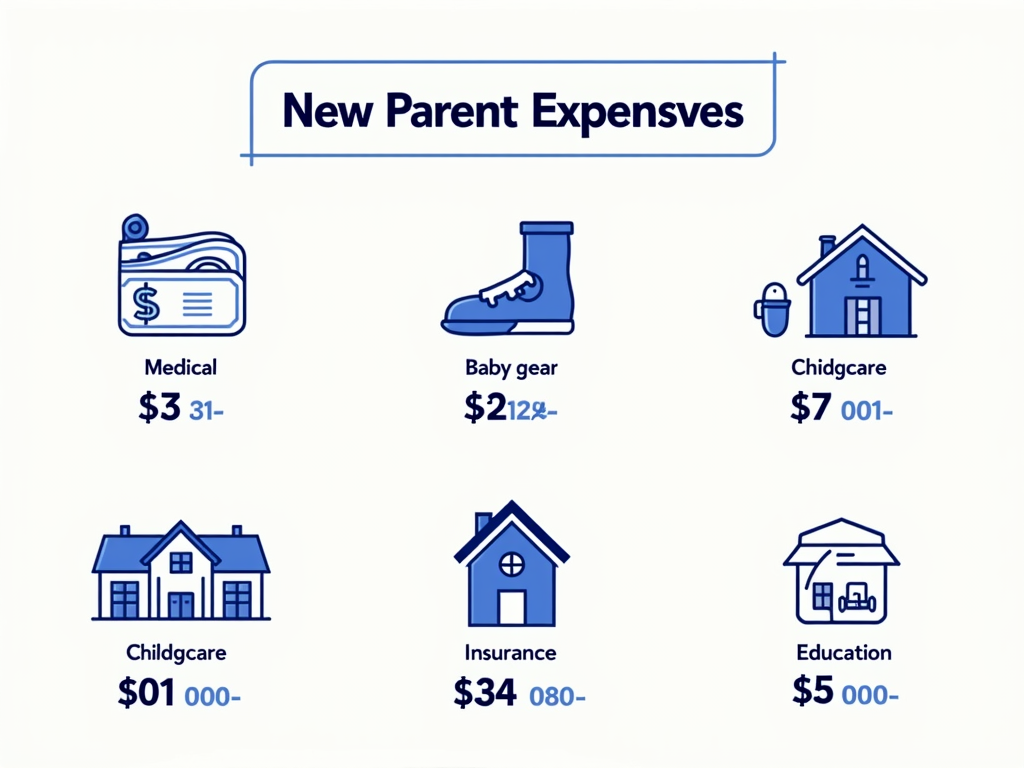

Understanding the Costs

Before you can budget, you need to know what you’re up against. New parents face a variety of expenses. Here’s a quick look at the big ones:

- Medical Expenses: Prenatal visits, delivery, and even fertility preservation if you’ve planned ahead. Fertility preservation costs can range from $5,000 to $15,000.

- Baby Gear: Think cribs, strollers, and endless diapers.

- Childcare: Daycare or a nanny can cost $500 to $2,000 a month.

- Housing: You might need more space or baby-proofing supplies.

- Insurance: Health and life insurance costs often rise.

- Education: College savings can start now.

These numbers can feel overwhelming, but breaking them down helps.

Here’s a sample cost breakdown:

| Expense Category | Estimated Cost |

|---|---|

| Medical Expenses | $5,000 - $15,000 |

| Baby Gear | $2,000 - $5,000 |

| Childcare | $500 - $2,000/month |

| Housing | Varies |

| Insurance | $100 - $500/month |

| Education | $50 - $200/month |

Your costs might differ, but this gives you a starting point.

Creating a Budget

Now that you know the costs, let’s build a budget. Follow these steps:

- Calculate Your Income: Add up your monthly take-home pay from all sources.

- List Expenses: Write down everything—rent, groceries, and new baby costs.

- Prioritize: Focus on must-haves like housing and childcare over extras like takeout.

- Set Savings Goals: Aim to save for emergencies and your baby’s future.

- Use Tools: Apps like Mint or YNAB can make tracking easy.

- Adjust Regularly: Life changes, so tweak your budget as needed.

When I had my first kid, I was shocked at how fast expenses added up. Budgeting saved us.

Here’s a simple budget template:

| Category | Budgeted Amount | Actual Amount |

|---|---|---|

| Income | ||

| - Salary | $X | $X |

| - Other | $X | $X |

| Total Income | $X | $X |

| Expenses | ||

| - Housing | $X | $X |

| - Groceries | $X | $X |

| - Childcare | $X | $X |

| - Savings | $X | $X |

| Total Expenses | $X | $X |

| Net Income | $X | $X |

Fill this out monthly to stay in control.

Saving Strategies

You don’t have to spend a fortune to be a great parent. Try these money-saving tips:

- Buy Secondhand: Thrift stores have gently used baby clothes and gear.

- Borrow: Ask friends or family for hand-me-downs like strollers.

- DIY: Make baby food at home—it’s cheaper and fresher.

- Shop Sales: Stock up on diapers during discounts.

- Cook More: Meal planning cuts grocery bills.

I once saved $50 by buying a secondhand crib. Small wins add up!

Long-Term Planning

Think beyond today. Your family’s future matters too. Consider these:

- College Savings: A 529 plan grows your money over time.

- Life Insurance: Protect your family with affordable term policies.

- Retirement: Keep saving for yourself, even a little.

- Estate Planning: Write a will to name guardians for your child.

Starting small now can make a huge difference later.

Seeking Financial Assistance

Some costs, like fertility preservation, can hit hard. Luckily, help exists. Look into financial assistance for fertility preservation through groups like [Organization Name]. They offer grants for treatments. Your job might also have benefits to cover fertility preservation costs. Don’t be afraid to ask—it’s worth it.

Conclusion

Budgeting as a new parent takes effort, but it’s doable. Understand your costs, build a budget, save where you can, and plan ahead. This How to Prepare for Parenthood: A Financial Guide gives you the steps to start. Take it one day at a time—you’ve got this!